There’s no question that banks and credit unions have seen significant (and permanent) shifts in the industry since the beginning of the pandemic. Consumer behavior has drastically changed, and the increasing demand for seamless omnichannel experiences will continue to push the bar for innovation in banking.

While the adoption of digital banking services continues to rise, there are still many reasons why customers prefer to do certain bank transactions in person. When it comes to making services and expert guidance available when, where, and how customers want, banks and credit unions have never had more options to be flexible. By providing an easy appointment scheduling process, customers and members can choose what works best for them.

According to our new 2021 Hybrid banking services research, customers want personalized banking services offered via both video appointments and in-person appointments. Here are some of the research highlights and trends to note:

Appointment scheduling is key to great customer service

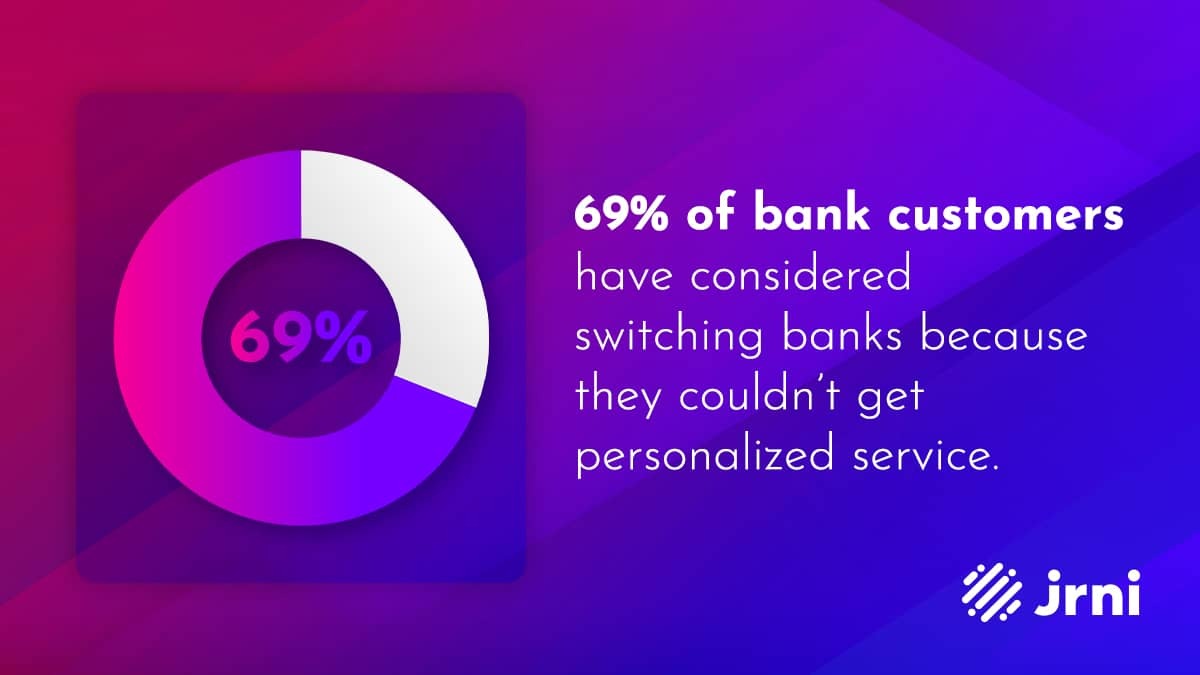

Banking consumers are looking to receive personalized digital and in-person services, and advice based on real-time changes in their lives. When customers receive personalized service, they feel valued and cared for. In fact, 69% of bank customers have considered switching banks because they couldn’t get personalized service.

This is why many customers and members are looking for easier ways to schedule banking appointments. Being able to secure one-to-one time ensures they are getting the help they need from an expert who cares. Providing easy access to speak with bank employees via appointments is crucial to improve the customer experience, as 33% of bank customers say they have found it challenging to talk to the right person at their bank in the past six months.

Ease, speed, and convenience are other important factors for customers. As they look to engage with their banks, 59% of customers think it will be faster to speak to a specialist if they schedule an appointment online.

In addition, more and more customers are looking for increased flexibility in hours to meet with their bank. In the past six months, 39% of bank customers have considered switching to a financial institution with more flexible service hours.

Providing a simple way for customers and members to book appointments can help meet the demand for personalized, convenient, and flexible banking.

Banking consumers want a mix of remote and in-branch appointment options

One trend that continues to hold strong is the need to provide hybrid banking services, both in-person and remote appointment options. Some customers and members want to bank in the branch, some want to do everything they can online, and some want to take a hybrid approach. Current trends for video banking appointments and in-branch appointments show that both are here to stay.

Video appointments

Video appointments are becoming increasingly popular as a way to bank. The top reasons customers want to bank remotely is to receive more personalized service, to avoid travel time to the branch, and to meet at a convenient time. Other video appointment trends to consider:

An increase in video appointment comfortability: 62% of bank customers say COVID and remote work have made them more comfortable with video appointments.

Customers choose banks that provide remote video services: 50% of bank customers say they would choose a bank based on the extent of their remote services.

Customers want to bank with an expert outside of normal business hours: 51% of bank customers expect bank employees to be available after normal business hours for video appointments.

In-branch appointments

There are still a number of services that customers would prefer to do in person. As the future of physical branches continues to be reimagined, important considerations for in-branch appointments include:

Customers want to bank in a branch to discuss loan options: The top reasons customers want to bank at a branch include mortgages, home equity loans, small business loans, and commercial real estate loans. The commonality among these transactions are the many options available and a desire to discuss with an expert.

Some customers still prefer in-branch banking versus remote: 45% of bank customers would prefer meeting with an agent in person compared to 34% who prefer a meeting via video.

Every customer and member will have a different journey and different ways they want to bank. To meet the demand of your entire customer base, in-person and video appointments remain imperative for your customer engagement strategy.

Bank customers increasingly expect not to wait in lines

As banking customers have adapted to on-demand services and more convenient ways to do business, the idea of waiting in line is becoming a thing of the past. In order to avoid waiting in a physical line at a bank, 56% of bank customers say they would prefer to schedule an appointment. This holds true across demographics:

56% of bank customers aged 23 to 40 say they would prefer to schedule an appointment over waiting in line.

59% of bank customers aged 41 to 60 say they would prefer to schedule an appointment over waiting in line.

43% of bank customers over 60 say they would prefer to schedule an appointment over waiting in line.

With the rise of hybrid banking, there’s a keen focus on balancing physical branches and online banking to improve customer satisfaction and loyalty. To learn more about what you can do to attract and retain customers while creating experiences that drive growth, then download the full report: Hybrid banking services research.