The retail banking industry continues to experience a great customer revolution. Driven by omnichannel consumers, new competition in digital and brick-and-mortar banking, and innovative technologies, bank executives and marketers are delivering better-than-ever experiences to consumers.

How omnichannel consumers are driving innovation in online banking

Without a doubt, the rise of mobile and online banking changed the way consumers bank, giving people convenient 24x7x365 access to their financial information and critical applications. For the last several years, customers have increasingly opened accounts and transacted with financial services via smartphones, tablets, and computers, leading numerous retail banks to shutter many of their physical branches.

Although 2020 saw an increase in conducting bank activities online only or via phone, the online banking experience is not suited to all customers and their needs. The reality is that retail banks are improving the branch experience, and customers are excited to conduct activities in-person again. Yet, the reality is that retail banks are improving the branch experience. Simultaneously – even if they like the convenience of online or mobile app banking – consumers have realized they find comfort in a bank’s physical presence.

While consumer desire to use both online and in-branch financial services can squeeze banks’ operating margins, banking executives have little choice but to satisfy customer demands. According to PWC’s Retail Banking 2020 report, retail banks recognize the need to deepen their customer relationships and focus more on specific customer outcomes in 2020 – regardless of channel. Novantas echoes the sentiment, stating that the banking industry finds itself in an awkward middle ground, having to balance investment in digital channels with the overhead costs of branches.

Innovation strategies in retail banking

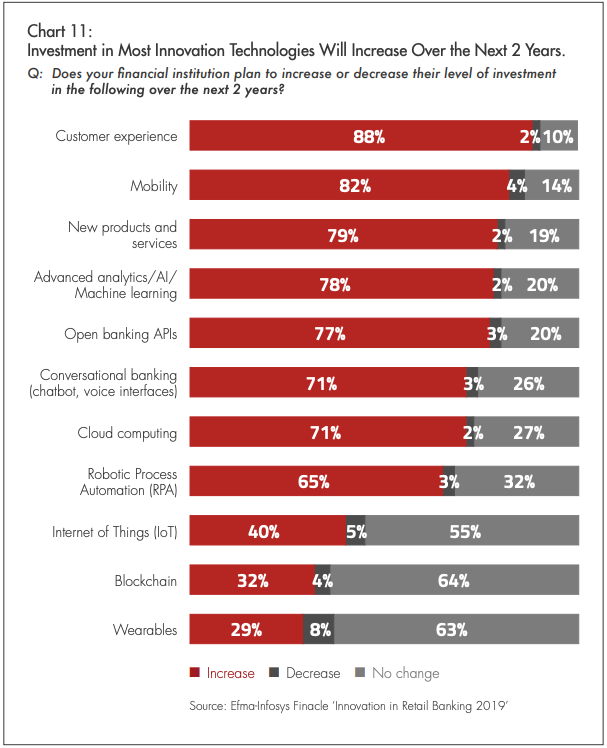

The percentage of financial services firms that invested more in innovation grew to 82% in 2018. The highest level of investment went to improving the customer experience, as you can see in the chart below from Efma.

Recognizing that consumers are demanding robust services in the digital and physical realms, banks blended their investments in both areas using innovative technologies. Let’s explore how financial institutions used them to maximize consumer satisfaction.

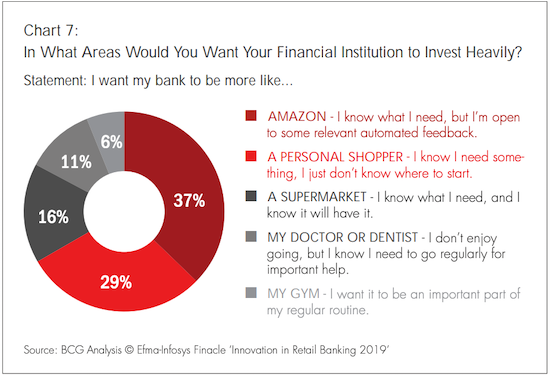

As BCG data reveals, banks acknowledged the overwhelming need to deliver both Amazon-like convenience and great “personal shopper” experiences, as the chart below demonstrates.

To deliver the convenience analogous to Amazon – where customers know what they want, but require some automated help – financial institutions called upon automation and AI.

Financial services companies using the joint DocuSign-Intelledox solution enable online consumers to engage with automated banking forms that guide them through a common process, such as initiating a loan request. As consumers select what they want to do, adaptive forms populate with relevant data and prompt the consumer on next steps. Once the consumer completes the guided forms, the system automatically launches a single or multi-party signing process. As with Amazon, there is no need for the consumer to visit the store/branch.

As for delivering a personalized consumer experience, the most immersive banking experience is the live, in-person meeting with a banking knowledge expert. But why stand around waiting for an available in-branch expert? This is where online appointment booking improves the experience.

Trends in retail banking innovation

Artificial intelligence

Artificial intelligence (AI) is impacting consumer-facing industries, and the financial services industry is no exception. Financial services firms are using AI and machine learning to improve customer service, deepen personalization, and optimize processes.

One particular area where AI is improving customer satisfaction and driving down costs is in customer service. With the right use of AI in customer service, a bank can can serve many customers simultaneously. The key is to enable self-service for simple tasks and reserve live customer service agents for the most complex or urgent matters. Financial institutions call upon modern customer service platforms that incorporate AI, in particular AI-driven voicebot/chatbot, to reduce the need for person-to-person interactions.

Neon Pagamentos, a fintech startup, is using an AI-driven customer service platform from Helpshift. The online bank has inexpensively scaled to support 600,000 users. At the same time, it is providing a fully conversational messaging experience that results in a consistent customer satisfaction score of 4+ (on a scale of 1 to 5). AI-driven support bots engage consumers in a conversation similar to one enabled by WhatsApp or iMessage. This makes it possible for customers to start a process, leave the conversation to tend to other things, and return minutes or hours later and pick up right where they left off.

Since digital-only banking startups are delivering this type of customer experience, it’s little wonder that 55% of bank executives responding to PWC’s Retail Banking 2020 survey view non-traditional players as a threat to traditional banks. Globally, bank executives say that enhancing customer service is the number-one investment priority for their business.

Two-factor authentication and biometrics

Along with customer service, retail banks must remain ever vigilant about fraud – especially as the industry adopts a growing number of digital products.

By now, most financial institutions are aware that fingerprinting and voice recognition greatly help to prevent fraud. Even small brick-and-mortar banks, like Cambridge Savings Bank in Massachusetts, offer fingerprint-based identification via Android for their customers as part of two-factor authentication — and that’s just scratching the surface. But that’s just scratching the surface.

Royal Bank of Scotland is among a handful of banks collecting biometric behavioral data, a newer type of biometrics that goes beyond the basics. Once a customer logs in, software records 2,000+ movements on the keyboard, mobile app and/or website. It even measures the angle at which a customer holds a smartphone, the specific fingers they use to swipe, and the pressure they apply when touching the screen. Given that banks spend $2.92 for every $1 of fraud, behavioral biometrics could be a major cost-saver in the financial services industry.

Voice-activated banking

Voice-activated banking is another area of opportunity. The number of smart speakers is skyrocketing, and Juniper Research predicts that 8 billion people will be using voice technology by 2023.

Banks can take advantage of several opportunities when it comes to voice technology, from simple requests to advanced scheduling. In addition to offering convenience for customers, banks will benefit from cost savings and time savings.

PwC found that 52% of call center time is spent on basic requests. If these rudimentary requests were serviced by a voice system, the potential cost reduction for banks could be as high as $3 billion (PwC). Furthermore, 67% of smart speaker owners are comfortable using voice technology for banking transactions, according to Mercator. It’s safe to say that consumers are ready for voice-activated banking.

A more advanced opportunity for banks to use voice technology is as a bridge between a customer’s digital and physical experiences. For more complex transactions, customers can use voice technology to book a branch appointment with an advisor. In fact, our research found that 26% of consumers prefer branch banking because they want to ask questions and get advice. Whether customers prefer to conduct banking transactions in-branch or via mobile app, voice technology can enhance the experience.

Learn more: JRNI’s smart speaker integration

Why you should act on retail banking innovations

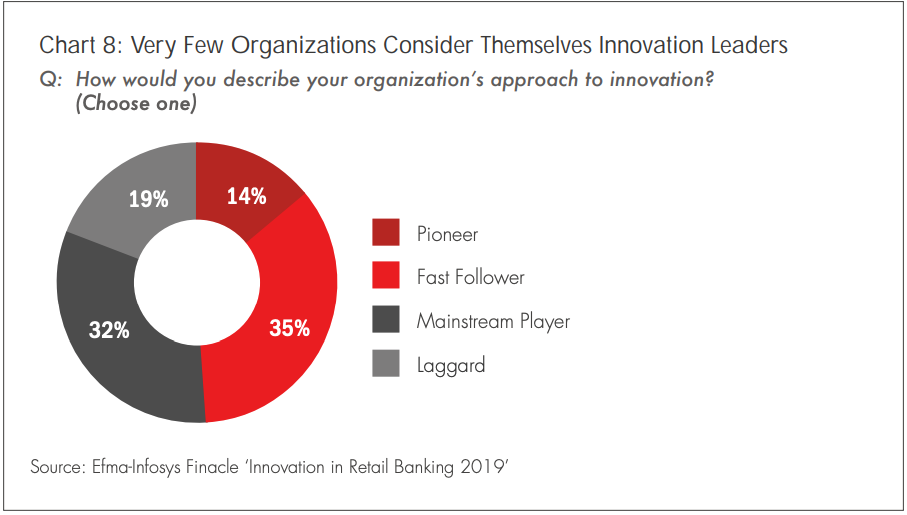

While most retail banks and credit unions don’t consider themselves pioneers in innovation, as the chart below demonstrates, more consider themselves ‘Fast Followers.’ This means that the financial services industry quickly follows leaders into innovations that help win business and reduce costs.

If your bank is not a pioneer or fast follower, you risk being displaced. According to McKinsey, banks only set aside 35% of their IT budgets for innovation and reinventing strategies -- a paltry sum when compared to the more than 70% fintech players spend. Considering that fintechs are already undercutting retail banks in basic areas like personal loans, this investment disparity is cause for concern.

We agree with PWC’s assessment on innovation in banking: “Staying the same is not an option. We believe that the winners will not only execute relentlessly against today’s imperatives, but will also innovate and transform themselves to prepare for the future.”

As banking trends continue to evolve, one thing is certain: customers want to bank with you on their terms. Appointments enable banks to maintain relationships with customers however, whenever, and wherever they prefer to engage. Want to learn more about how appointment scheduling can set your financial institution up for success? Then be sure to check out our eBook "A case for appointments"!